4 Bar Rang Method: In my day-to-day activities of scalping and short-term trading in stock indices and high-volatility forex pairs like GPJPY and XAUUSD, I prefer using a 5-minute chart. An effective and manageable entry technique that I employ is the 4-bar Range method. This method serves as turning points or continuation points in existing trends and is mechanical in nature, involving the analysis of four candles or bars. It can be applied to any time frame, with a more significant impact on longer time frames. This technique examines the close of the current candle and requires the close to be higher than the previous three candles for a buy signal or lower than the lowest point of the last three candles for a sell signal. The method can be implemented in two ways: before the candle is closed or after it has already closed. The latter offers more confirmation but may result in entering trades later in newly formed market movements. I personally prefer the current close method as I like to trade during momentum formations. This method shares similarities with Dr. David Paul’s approach and is also utilized by traders such as Tom Hougaard.

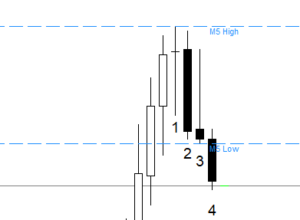

- For a buy signal: The close of the current bar (1) must be higher than the highest point of the last three bars (2, 3, 4).

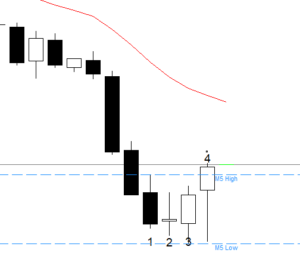

- For a sell signal: The close of the current bar (1) must be lower than the lowest point of the last three bars (2, 3, 4).

While the 4-bar Range method can be used as a standalone technique, I recommend combining it with other factors, such as significant trading levels, yesterday’s high or low, and closing prices. Additionally, it can be used in conjunction with the 3-day pattern, as described in another article. Traders should be mindful that other factors, such as news-related events, can also influence the markets.