Introduction:

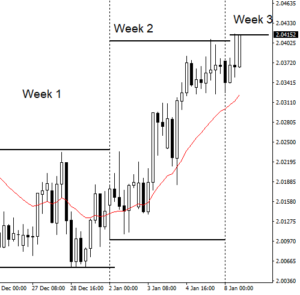

Today, GBPNZD exhibited a three-day pattern characterized by three consecutive upward movements. This presented traders with enticing opportunities, especially considering the absence of any significant British Pound or Kiwi-related news. Let’s delve into potential entry points for traders.

Pattern:

As mentioned earlier, GBPNZD formed a three-day pattern (three consecutive highs), mirroring a similar trend on the weekly charts. This implies not only a daily pattern but also a corresponding weekly one, both culminating in three successive new highs. This occurrence transpired from Thursday to Friday and spanned Week 52, Week 1, and Week 2 of the new year, all resulting in three consecutive highs.

Levels, entry, exit:

Traders should have anticipated specific market levels in this scenario. The initial daily high broke above Friday’s highs (2.040836), occurring around the London open at 9:05 (CET). At this point, traders could have engaged in a continuation trade, potentially closing the trade at breakeven. The plot thickened at 9:35 (CET) when the first indications of a reversal trade emerged in both the three-day and three-weekly templates.

Utilizing a 5-candlestick structure, the initial break occurred between 9:35-9:40. For a more favorable entry, traders could have targeted 9:40-9:45 (CET) when the candle exhibited minimal buying pressure after a significant preceding bearish candle. The lowest point during the London session was 2.035027, potentially resulting in a gain of around 45 pips. A reasonable stop would have been approximately 25 pips, making this a viable trade scenario.

Post Views: 727